How Credit Inquiries Affect Your Credit Score?

When you are shopping around for a mortgage you want to get the best rate, you might worry that having your credit checked by several lenders could hurt your credit score. The good news is that most credit score calculations treat all mortgage as a single inquiry, as long as the inquiries are made within a certain period of time. For the latest version of the FICO Score, this period is 45 days.

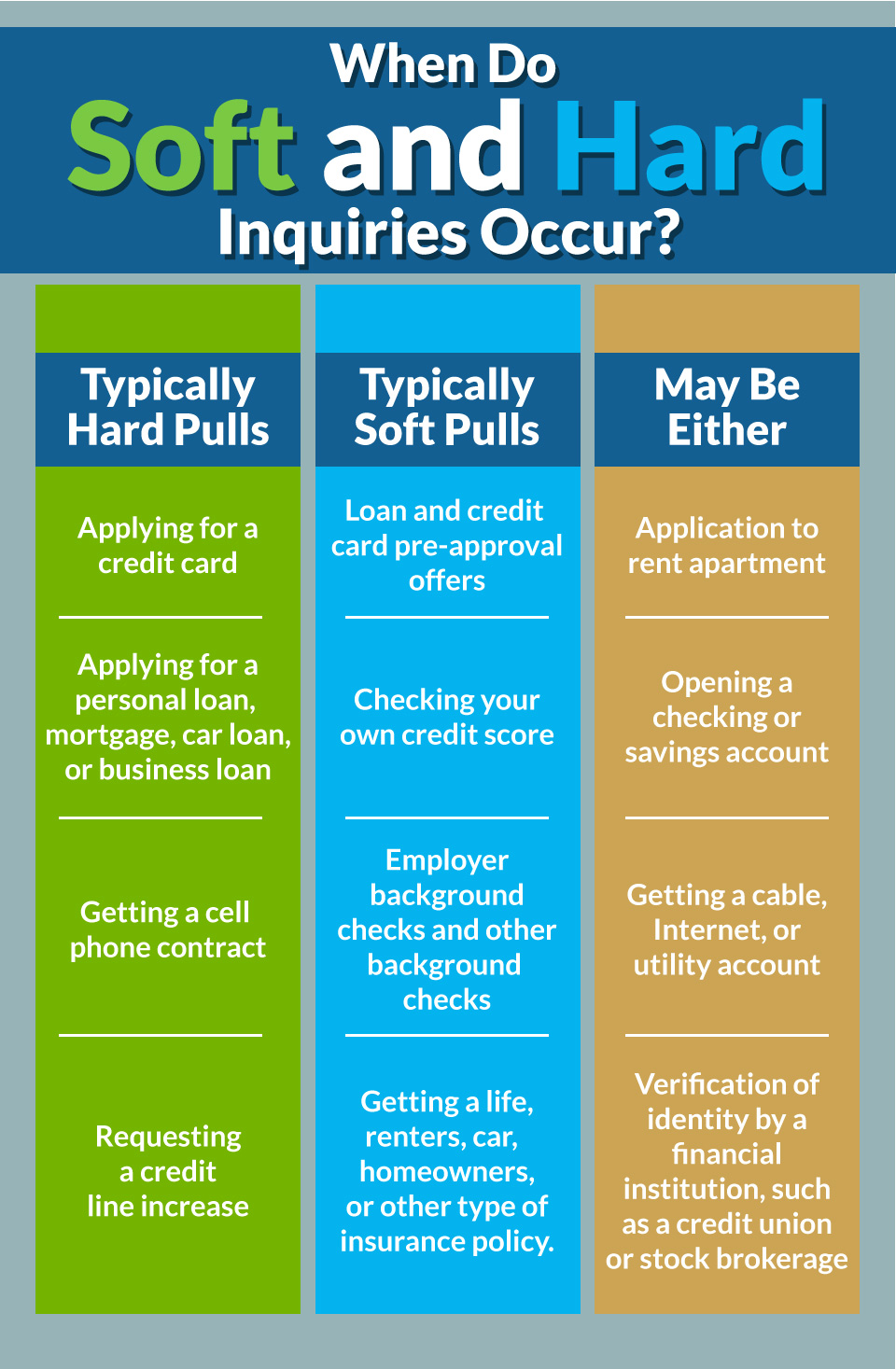

There are two types of inquiries:

Voluntary, hard inquiries and soft inquiries. Voluntary, or hard inquiries are the only credit inquiries that count towards your credit score. Inquiries that are made because of an application you made. Soft inquiries (involuntary inquiries), I like to call them are the ones that other businesses might check your credit report because they want to offer goods and services to you, or for employment reasons. None of these soft inquiries count towards your credit score. The version of your credit report you see includes all inquiries made into your credit report within the past 24 months. When lenders and creditors look at your credit report, only the hard inquiries appear. Credit report inquiries will remain on your report for two years, but only those made within the last year are included in credit score calculations. The most recent inquiries have the most effect on your score.

Ten percent of your credit report considers the number of requests you made at your credit report. Each of these requests, or credit inquiries, is recorded and included on your credit report, and stays on your credit for 2 years.

Companies who access your credit report under false deceptions or those who use it illegally are in violation of Federal law. You can protest to all three credit agencies if you notice something that should not be on your credit report. The agencies have then 30 days to respond to you if you send them letter by certified mail, and return read receipt, like I do.

The Fair Credit Reporting Act (FCRA) requires businesses to have an acceptable reason for accessing your credit report. Acceptable reasons include:

- To grant credit. If you have applied for a credit card, loan, or other credit-based service, the business has permission to access to your credit report to determine whether you qualify.

- Collect a debt. Debt collectors can use your credit report to obtain information, like your address or place of employment, that would help them collect a debt.

- Underwrite insurance. Some insurance providers use your credit score to gauge the likelihood that you will file a claim.

- Employment. Current and prospective employers may check your credit report before hiring you for certain positions, especially financial and upper-level management positions.

- Some government agencies may check your credit report before issuing certain licenses.

- Legitimate business transactions.

To get pre-approved and see if you qualify, contact me at my cell phone (847) 924-0733 and I will get you in touch with best lender in the area.